Este es un postblog de Richard Eldridge (co-fundador y CEO of Lenddo), colaborador para esta sección especial.

Con el auge de las startups Fintech especializadas en la aplicación de Big Data para la verificación de la identidad y la puntuación de crédito, podría ser más fácil que nunca para los proveedores de servicios financieros el mantener el ritmo de la innovación y ofrecer un mejor y más eficiente servicio a sus clientes.

En 2016, los consumidores ya no son lo que solían ser. Son muy exigentes, y ahora son conocedores de la tecnología y se enfocan en la experiencia. El tiempo en el que aceptaban llenar formularios de solicitud con 176 campos y perder más de media hora rellenandolo se ha acabado y grandes empresas orientadas al consumidor están quedando atrás en la carrera de la innovación y la modernización en su lucha por comprender lo mucho que el comportamiento de los consumidores ha evolucionado. Para hacer frente al desafío de promover un ambiente adecuado para los cambios, los bancos y otras instituciones financieras han creado tecnologías innovadoras para obtener una perspectiva competitiva, especialmente en los mercados emergentes, donde la penetración de los llamados “smartphones” está creando nuevas tendencias. En Filipinas, por ejemplo, se espera que la penetración de teléfonos inteligentes pase de un 40% a un 70% en los próximos tres años. En Brasil, cerca de 60 millones de personas están utilizando teléfonos de nueva generación, entre los cuales 78.62% tienen un sistema operativo Android únicamente. En los últimos años, el mercado ha evolucionado considerablemente y, a raíz de los últimos casos de éxito que involucran nuevos tipos de datos digitales de los mensajes de correo electrónico a las pruebas psicométricas, los oficiales de riesgo de crédito están ahora más abiertos en el uso de técnicas de aprendizaje automático avanzadas para construir algoritmos predictivos «.

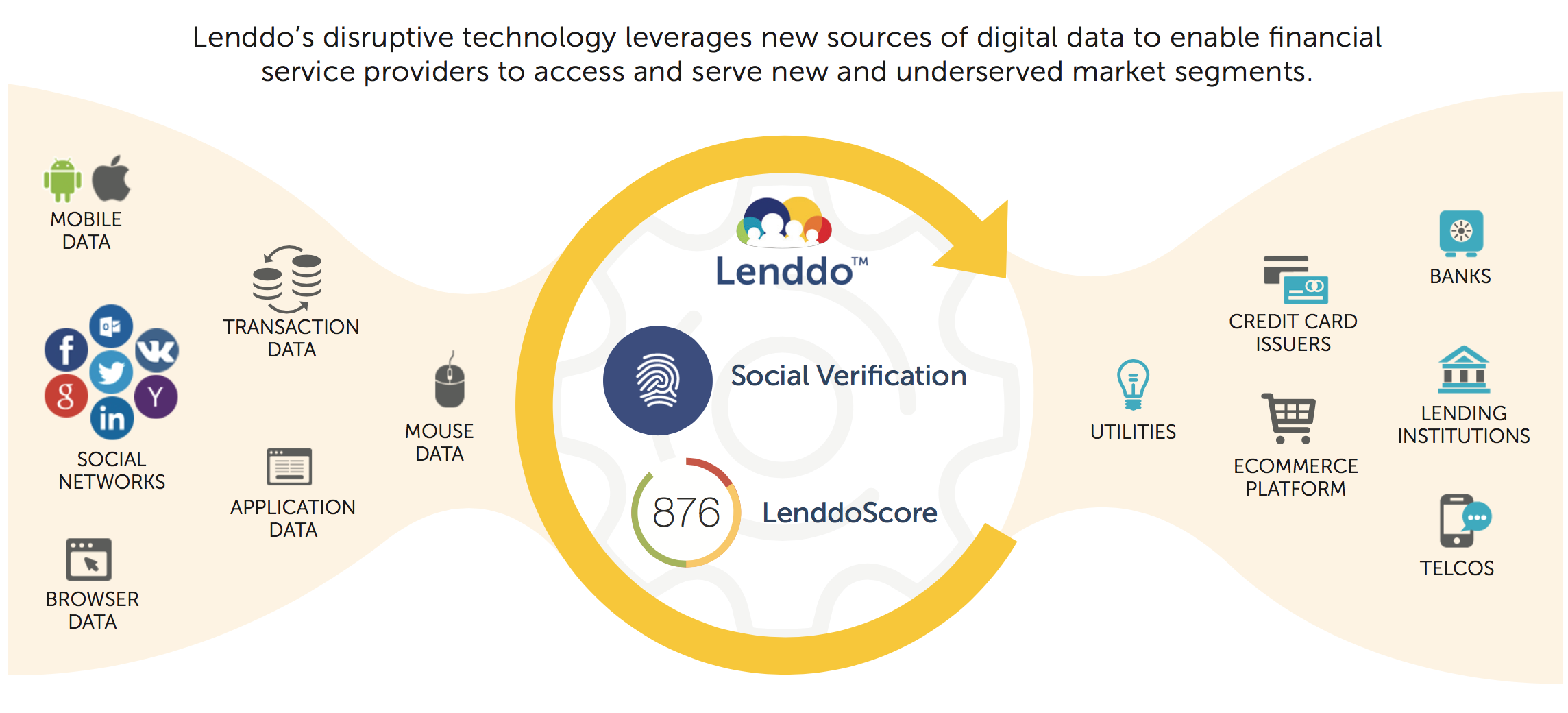

Empresas de tecnología financiera como Lenddo ahora están usando principalmente datos no tradicionales para ofrecer soluciones vanguardistas con el fin de ayudar a los socios a mejorar sus ofertas y reconectar con sus clientes hiperconectados. Su lectura única sobre variables de comportamiento derivados de la utilización que uno pueda tener con un teléfono inteligente, una cuenta de Facebook o un email, permite a la marca un nuevo enfoque del riesgo definiendo claramente la propensión – o «carácter» – a pagar de un individuo. Las instituciones financieras en la India, América Latina o el sudeste asiático, como los bancos, emisores de tarjetas de crédito y prestamistas P2P, están reestructurando y racionalizando sus procesos para responder mejor a un entorno en constante cambio. En cuanto a la India en concreto, se trata de un elemento de cambio para más de 635 millones de personas que actualmente se encuentran sin servicios bancarios, pero potencialmente con huellas digitales muy fuertes.

A pesar de que los reglamentos y regulaciones, tanto interna como externamente de las instituciones financieras, pueden ralentizar el proceso de innovación, estas tecnologías disruptivas se basan principalmente en datos opt-in, es decir, los datos sólo están disponibles a través del consentimiento del consumidor, de Facebook o Google, para proporcionar análisis de su comportamiento. Y con los resultados devueltos inmediatamente a través de las API en cuestión de segundos, estas empresas pueden ahora crear experiencias sin fricción para los clientes tanto en tienda y en aplicaciones móviles. Estos nuevos desarrollos están generando muchas oportunidades para dar acceso a la banca a los dos billones de personas que no tienen acceso a la misma en todo el mundo, pero no deben ponerse en práctica sin la validación y gestión mediante políticas y marcos de gestión de crédito internos.

Ciertamente, nada sucede de la noche a la mañana, pero la reciente evolución observada en los mercados emergentes muestra que las instituciones financieras están adoptando cada vez más la modernización como un paso obligatorio para escalar rápidamente y seguir siendo competitivas, para brindar el mayor beneficio de los consumidores.

Sobre Richard Eldridge

Richard es el co-fundador y CEO de Lenddo, líder mundial en tecnología de autenticación social y puntuación a partir de datos no tradicionales. En enero de 2015, después de 4 años de préstamos, Lenddo abrió, sus tecnologías para terceros, tales como bancos, entidades de crédito, empresas de servicios públicos y compañías de tarjetas de crédito en todo el mundo para reducir el riesgo, aumentar el tamaño de la cartera, mejorar el servicio al cliente y verificar a los solicitantes. Antes de Lenddo, Richard ganó más de 6 años de experiencia en la gestión de consultoría en Renoir Consulting, que opera a través de diversas industrias y funciones de negocios en más de 8 países. Desde su creación en 2001, Richard ha sido conocido como uno de los pioneros en la industria del outsourcing en las Filipinas, habiendo creado exitosamente dos empresas de outsourcing, Summersault y Infinit-O. Además, es director de la British Chamber and the European Chamber of Commerce Philippines. Recibió su Bachelor’s degree en Management Sciences por la Warwick University en el Reino Unido.