Leading the way with Benchmark reports in Latin America

Our unwavering commitment to the development of the Latin American Fintech ecosystem positions us to engage with startups, financial entities, investment funds, major tech firms, regulators, public institutions, and other organizations. This deep engagement allows us to immerse ourselves in the core of financial innovation and entrepreneurship, granting us exclusive access to groundbreaking data and unique insights that place our reports at the forefront of the sector.

Our clients rely on us to meticulously research and analyze the state of the ecosystem and to influence a wide range of stakeholders, including governments, financial institutions, insurers, Wall Street and Silicon Valley investors, and regional VC funds.

Public entities utilize Finnovista's research reports to influence regulators or attract investors, among other objectives, while private companies leverage our expertise to define and execute innovation strategies and establish alliances with startups.

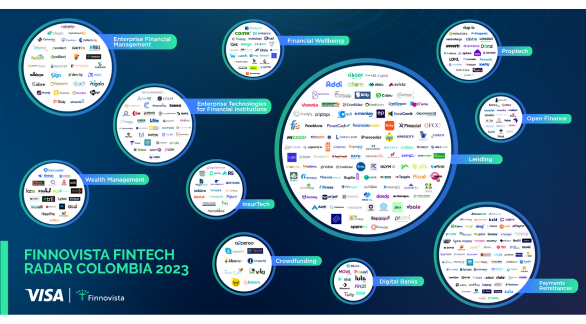

Renowned for their quality, our Finnovista Fintech Radars are published annually, providing a comprehensive analysis of Fintech innovation across Spanish-speaking countries in Latin America. In addition to offering sponsorship opportunities for these reports, our clients have access to other research services that can be distributed openly or for private internal use.

Our services

Sponsorship of the Finnovista Fintech Radars

Every year, we delve into the dynamic world of financial technology through the update and publication of the Finnovista Fintech Radar. These analyses offer insights into the growth of the entrepreneurial ecosystem in the Fintech industry and explore crucial areas within the sector.

These radars serve as valuable reference reports at both regional and international levels. They provide detailed insights into the local ecosystems of various Spanish-speaking countries in Latin America, covering the macroeconomic landscape, challenges, competitive advantages of startups, technological trends driving sector transformation, regulatory impacts, emerging trends, investment insights, and the presence of foreign Fintech companies in local markets.

Commissioned reports

Our Commissioned Reports are invaluable tools for obtaining detailed and customized information on specific topics of interest, whether regional or by country. These reports offer a panoramic view of the entrepreneurial ecosystem in the financial industry, addressing particular issues, providing detailed analysis, and offering recommendations based on collected data. They cover crucial areas such as financial inclusion, technological spectrum, collaborative systems, Fintech segments in Latin America, business concentrations, regulation, and tools for entrepreneurs and regulators.

Financial institutions, insurers, investors, and governmental entities rely on our research and analysis to devise innovation strategies, establish partnerships with startups, and drive their development.

Disruption Maps

We conduct ad-hoc disruption mappings to identify and analyze emerging trends with the potential to affect or transform the financial industry, impacting entire companies or business units. These mappings help corporations and investors understand current and future trends, enabling them to anticipate changes and adapt their innovation or investment strategies accordingly.

Ad-hoc research

We develop fully customized research for our clients in areas such as venture capital investment, different startup models, corporate collaboration, regulatory benchmarks, and financial inclusion, among others.