In this second edition of Finnovista’s Fintech Radar Mexico, a total of 158 Mexican Fintech startups have been identified, positioning Mexico as the single largest Fintech market in Latin America, clearly surpassing other leading markets in the region such as Brazil (130 startups), Colombia (77 startups) or Chile (56 startups).

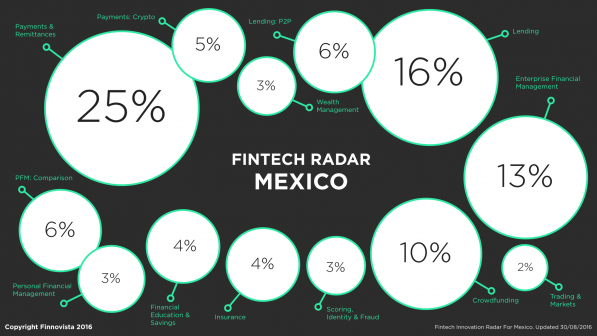

Compared with the first edition of Fintech Radar Mexico released in May 2016 where 128 startups were identified, the 158 of this second edition represent a 24% increase in the number of startups. The most significant increases in segments have occurred in Crowdfunding (+ 60%), Financial Education and Savings (+40%), Payments and Remittances (+34%) and Enterprise Finance Management (+33%).

This second edition of Finnovista’s Fintech Radar Mexico is the biggest initiative of monitoring and tracking Fintech market in Mexico until now in the whole region. The 158 Fintech startups identified by Finnovista in this second Fintech Radar Mexico are already changing the rules of the game in all segments of the financial services industry. These 158 startups are competing to win in the next 10 years, up to 30% of the banking market in Mexico, worth more than US$30 billion, in addition to expanding the frontiers of the financial services market through the financial inclusion of the unbanked or underbanked population.

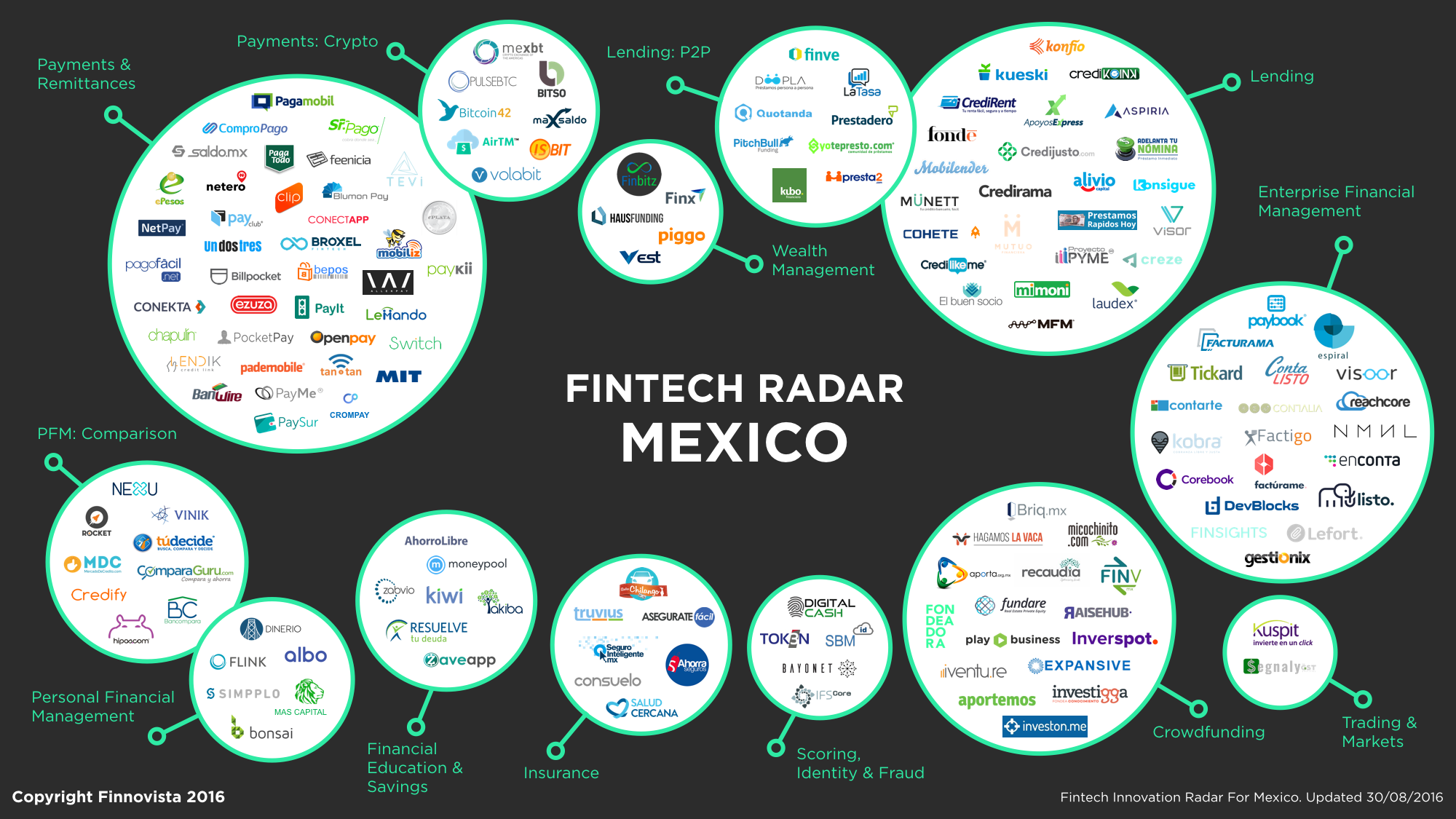

The Fintech Radar Mexico has identified 10 segments where all Fintech innovation in Mexico is concentrated: Payments & Remittances, Lending, Enterprise Finance Management, Personal Finance Management or PFM, Crowdfunding, Wealth Management, Insurance, Financial Education and Saving, Scoring Solutions, Identity and Fraud, and finally Trading & Markets.

The time has come for banks and other Mexican financial institutions to recognize the great opportunity for the country and the whole financial sector through the empowerment of Fintech, and to commit to deploy collaborative innovation strategies that can connect them and integrate them with the national and international Fintech ecosystem.

From Finnovista, we would like to thank our network of mentors who have collaborated in this Fintech Radar Mexico, including: Amanda Jacobson, Daniel Lacy, Joel Cano, Matthieu Albrieux, Pablo Prieto and Vicente Fenoll. Thanks to everyone for your support.

Have we missed any Mexican Fintech startup in our Fintech Radar?