Finnovista has conducted different Fintech Radar reports about the most important countries in the Ibero-american region in order to create a comprehensive data source of the Fintech enterprises, evaluate the sector’s progress in the region, and give visibility and recognition to a movement that will lead the region towards an ubiquitous and inclusive digital finance landscape. So far, Finnovista has published Fintech Radar studies about Argentina, Brazil, Chile, Colombia, Ecuador, Spain, Mexico and Perú. Likewise, in May 2017 Finnovista published the most exhaustive and the only report published to date about Fintech Innovation in Latin America in collaboration with the Inter-American Development Bank (IADB).

On this occasion, Finnovista is publishing the first part of the report about Fintech innovation in Spain through an update of the Fintech Radar Spain, which its last edition was published in July 2016. In the second part, which we will publish before the end of the year, we will share a more in-depth analysis about the Spanish Fintech ecosystem, as we conducted in Colombia, Mexico and Brazil. In order to carry out this detailed analysis, we invite each of the startups included in this updated version of the Fintech Radar Spain to respond to a survey that will be sent in the following weeks and that will be published in an aggregated form, not individually. From Finnovista, we are convinced that by publishing and sharing this level of information we will contribute to strengthening the Fintech sector in Spain and in the Ibero-american region, giving visibility to new Fintech companies, connecting them with other ecosystem players and driving the sector’s growth in the country, as well as its connection with the rest of the Ibero-american region.

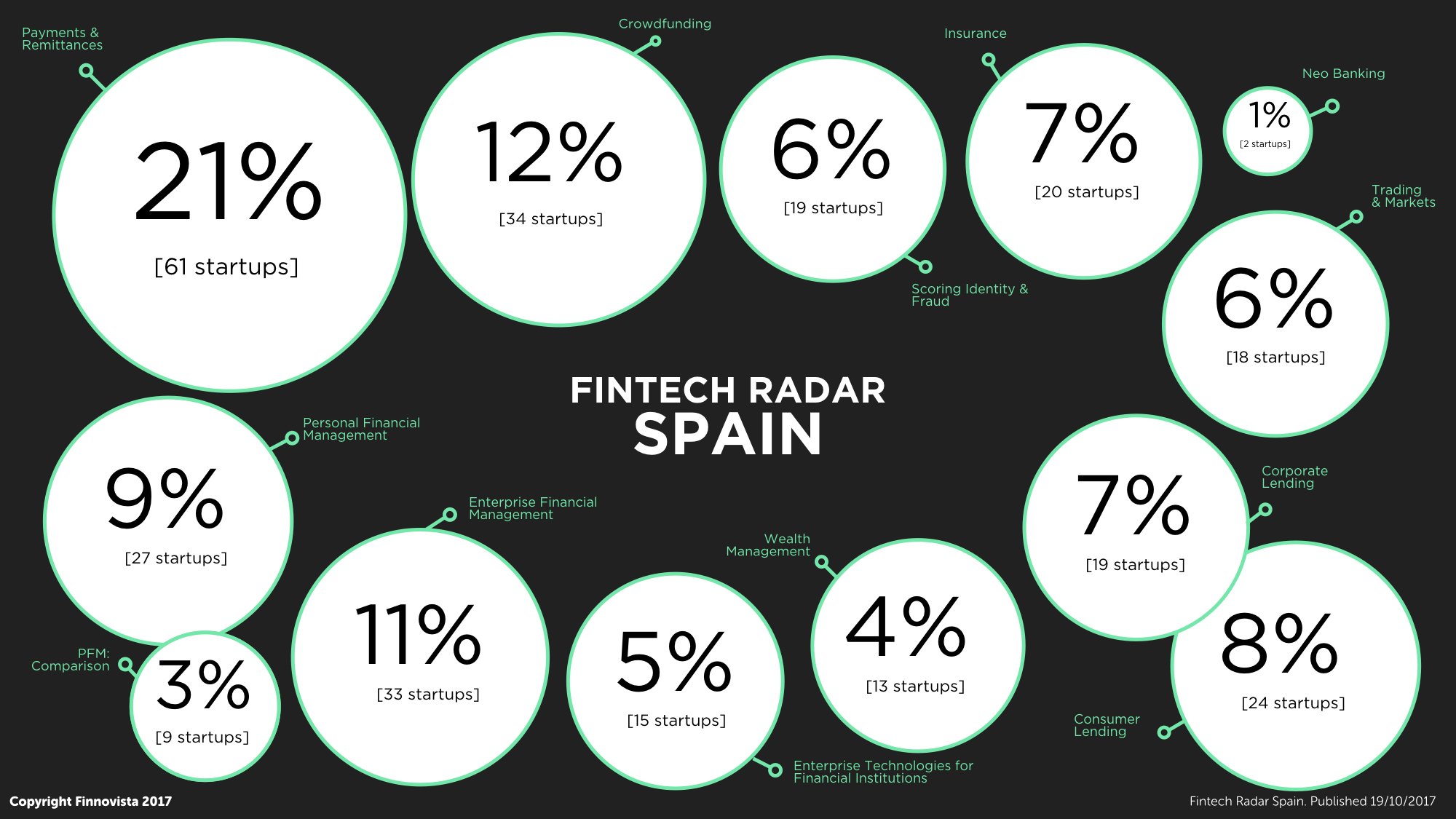

The identified startups in this analysis are distributed among 11 Fintech segments, with five major segments in the Spanish market and six emerging ones.

The five major segments are composed by:

- Payments and Remittances with 61 startups, 21% of the startups.

- Lending with 43 startups, accounting for 15% of the startups in the country.

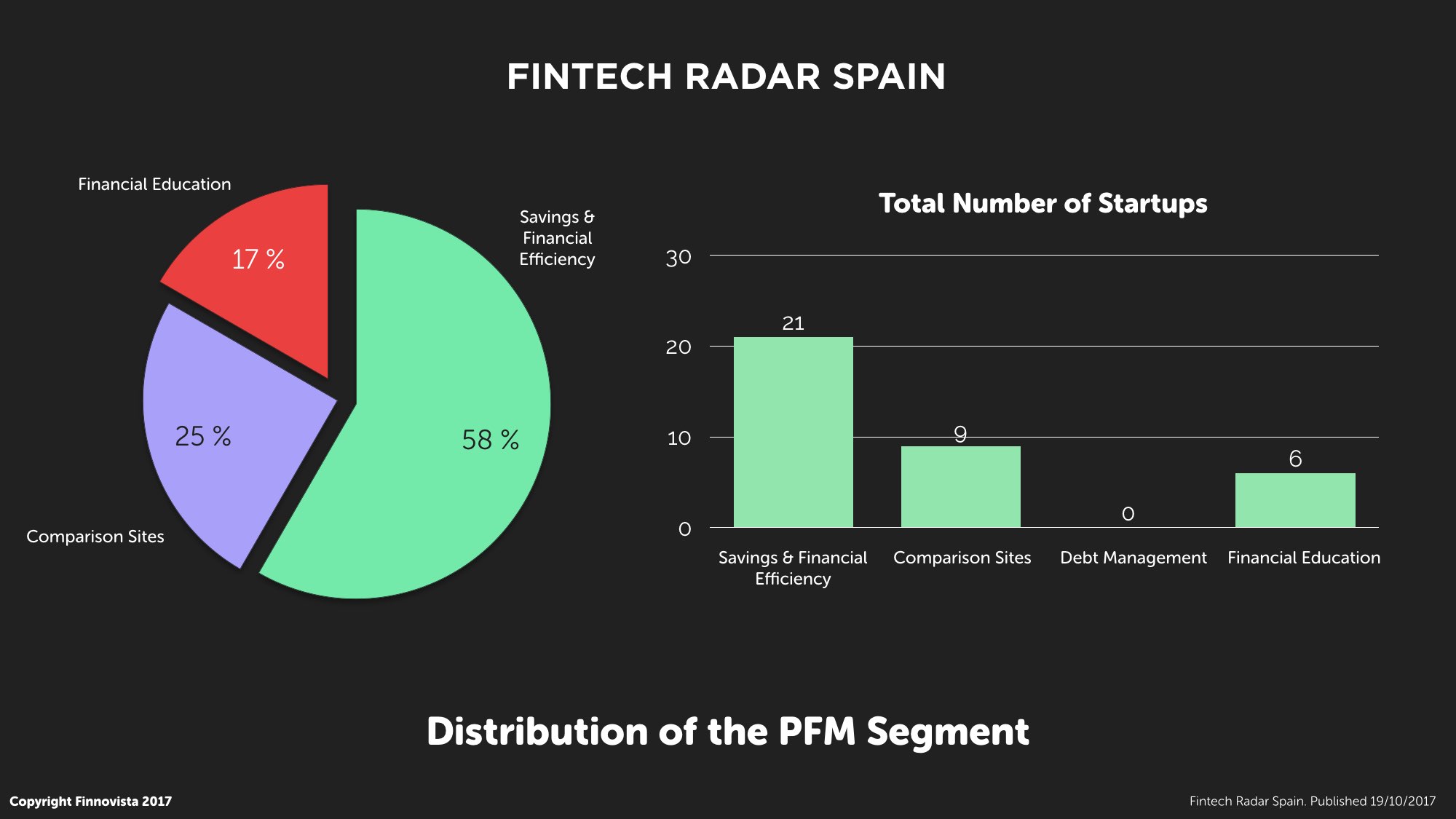

- Personal Financial Management, with 36 startups, covering 12% of the identified startups.

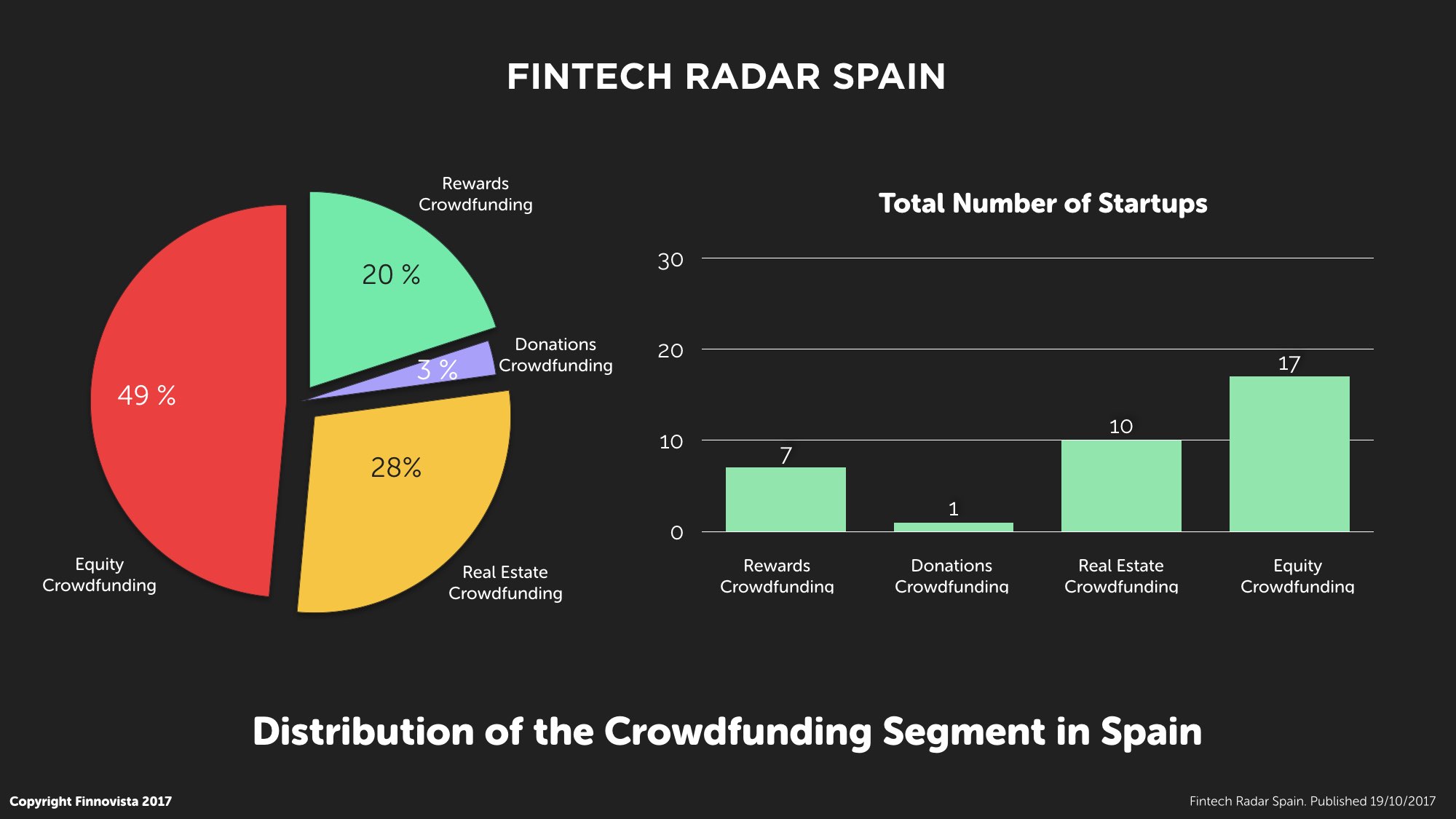

- Crowdfunding, with 34 startups, representing 12% of the total number.

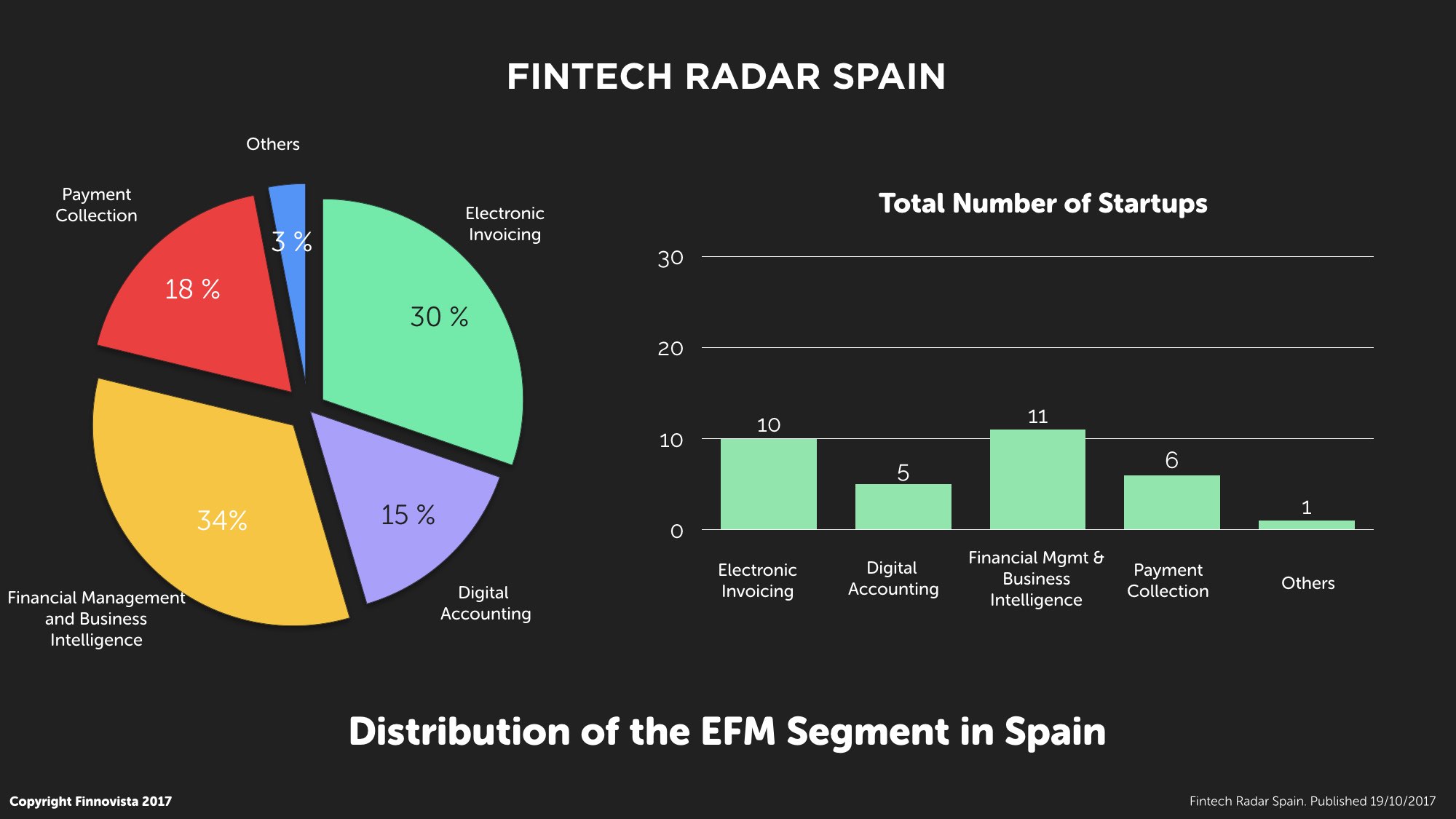

- Enterprise Financial Management with 33 startups, 11% of the startups in the country.

The six emerging segments are all under 8% of the total number of Fintech startups identified in the analysis, which include Insurance (7%), Scoring, ID & Fraud (6%), Trading & Markets (6%), Enterprise Technologies for Financial Institutions (5%), Wealth Management (4%) and Neo Banking (1%)

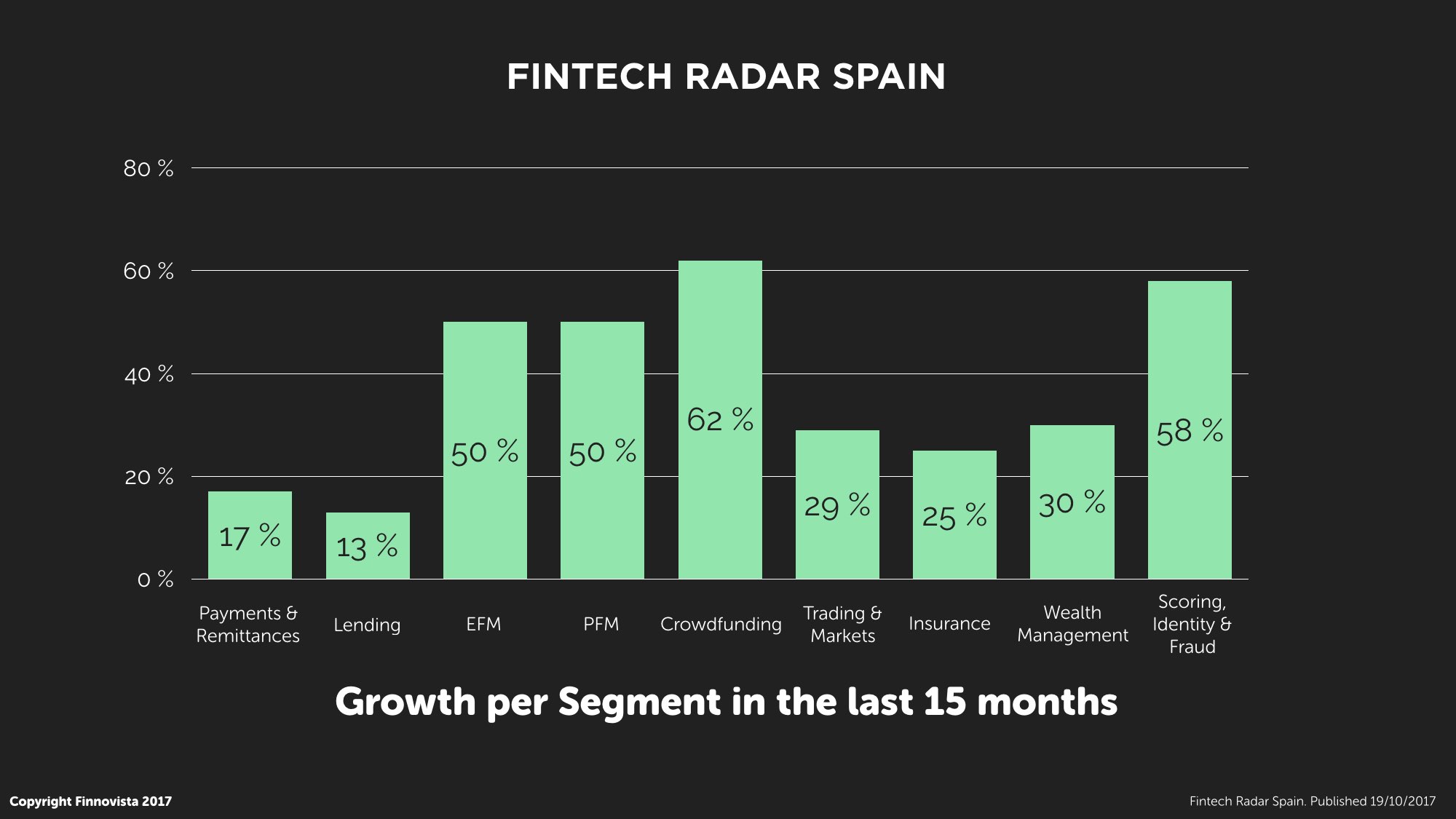

The growth experienced by the Spanish ecosystem has been driven mainly by four segments, which have grown over 50% in the past 15 months:

- Crowdfunding has grown 62%, from 21 to 34 startups. If we take into account that 7 Crowdfunding startups disappeared or became inactive, we observe that 20 new startups were created during this period, which means that almost 2 of every 3 Crowdfunding startups have been created in the past 15 months.

- Scoring, ID & Fraud grew by 58%, from 12 to 19 startups, with no startups disappearing during this period.

- Personal Financial Management grew by 50%, from 24 to 36 startups. If we take into account that 4 PFM startups disappeared or became inactive, we observe that 16 new startups were created during this period, which means that almost 1 of every 2 PFM startups were created in the past 15 months.

- Enterprise Financial Management also grew by 50%, from 22 to 33 startups, with no EFM startups disappearing during this period.

Distribution of solutions in the major segments

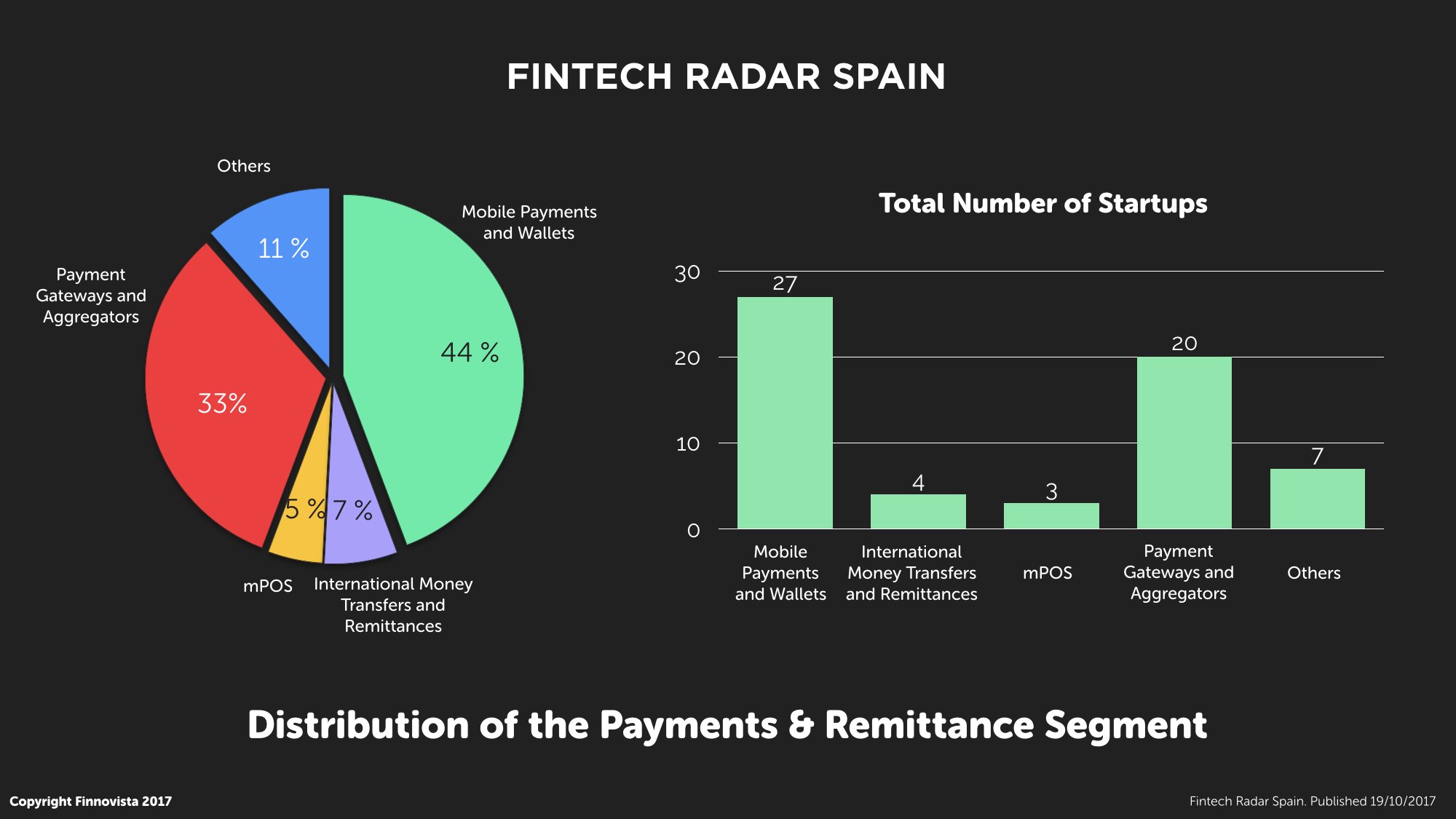

We have analysed the distribution of the Payments and Remittances segment and we observed that 44% of the Fintech solutions that make up this segment are Mobile Payments and/or Wallets, 33% offer services of Payment Gateways and Aggregators, 7% enable International Money Transfers and Remittances, while 5% are Mobile Points of Sales (mPOS) and the following 10% have been identified as “Other” payment solutions.

Spain positions itself as the largest Ibero-american ecosystem

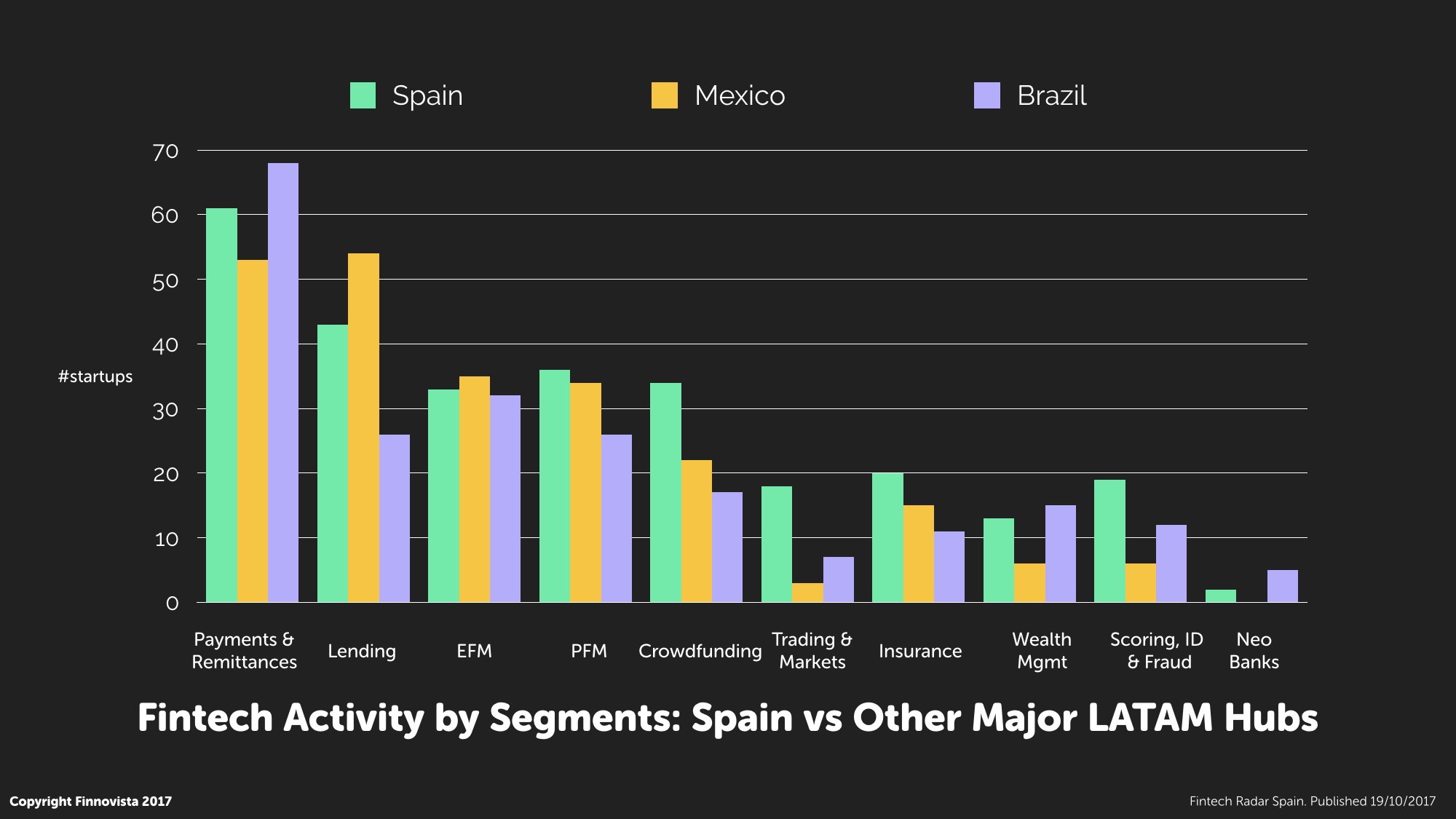

The 294 identified Fintech startups position Spain as the largest Fintech ecosystem in the Ibero-american market, ahead of the 3 main Fintech markets in Latin America: Mexico with 238 Fintech startups, Brazil with 230 and Colombia with 124.

The distribution of the different Fintech segments in Spain has a similar pattern in comparison with the main Fintech ecosystems in Latin America, where most of the Fintech activity is concentrated in the following segments: Payments and Remittances, Lending, Personal Financial Management, Enterprise Financial Management and Crowdfunding.

When analyzing the distribution of the Fintech segments in Spain, Mexico and Brazil, we observed that Spain leads the total number of startups in the following segments: Personal Financial Management, Crowdfunding, Enterprise Technologies for Financial Institutions, Trading and Financial Markets, Insurance and Scoring, ID and Fraud.

Likewise, Mexico leads the total number of startups in Lending and Enterprise Financial Management, while Brazil is ahead in the segments of Payments and Remittances, Wealth Management and Neo Banking.

What is the next step for the Spanish Fintech ecosystem?

Since 2015 London has been recognized as the global Fintech hub, and since then it has been the most representative example of the sector’s potential. Until now it has maintained its recognition as the number one Fintech center in Europe, but with the awaited exit of the United Kingdom from the European Union, an opportunity arises for other capital cities with strong financial activity to attract Fintech companies and benefit from the job and wealth creation.

However, from Finnovista we are convinced that the greatest opportunity for the Spanish Fintech lies in the creation of a healthy ecosystem interconnected with Europe and Latin America, attracting the best European talent to cities like Madrid or Barcelona, in order to create from there the future leaders of the Ibero-american digital financial industry. History repeats itself: banks were the first to cross the Atlantic, and in a digital era of democratization of innovation, technological startups will be the ones to take the first step and grab this opportunity. Spanish Fintech startups like Fintonic, Aplazame and Bdeo are already operating across the Atlantic, with this last startup having participated in Finnovista’s acceleration program in Mexico City through our partnership with Startupbootcamp Fintech.

Lastly, we would like to remind all startups that have been included in this Fintech Radar Spain the invitation to respond to the survey that will be sent in the following weeks and that will not be published individually, but aggregated. From Finnovista, we are convinced that by publishing and sharing this level of information we will contribute to strengthening the Fintech sector in Spain and in the Ibero-american region. If you are a Fintech startup and you haven’t heard from us in the following weeks, we please ask you to request the survey through an email to: [email protected]

From Finnovista, we want to thank our collaborators, which have contributed to the update of the Fintech Radar Spain, among them: Fernando Cabello Astolfi, Javier Megías, Pablo Ruiz Correa and Ángel González. Thank you all for your support.

Do you know about a Spanish Fintech startup that has not been included in our Fintech Radar ?